An investment strategy that aims to balance risk and reward by dividing the portfolio of assets in accordance with individual goals, risk tolerance and investment horizon. The three main asset classes - equities, fixed income, and cash and equivalents - have different levels of risk and return, so each will behave differently from time to time.

There is no simple formula that can find the right asset allocation for each individual. However, the consensus among most financial professionals is that asset allocation is one of the most important decision that makes investors. In other words, your choice of individual effects secondary to the way you allocate your investments in stocks, bonds, and cash and equivalents, which will be the primary determinant of your investment results.

Asset allocation mutual funds, also known as life-cycle or target-date funds, an effort to provide investors with portfolio structures that address investors' age, risk appetite and investment objectives with the appropriate asset class divisions. However, these critics point out that arriving at a solution approaches the standard for allocating portfolio assets is problematic because individual investors require individual solutions.

Asset Allocation as a Tool for Investment

1. Asset allocation is an Investment Planning Tool, not the Investment Strategy ... investment professionals who understand the difference, because most think that the Investment Plan and Financial Planning are the same thing. Financial planning is a broader concept, and one that involves such non-investment considerations as Wills and Estates, Insurance, Budgeting, Trusts, etc. Investment Plan occurred in the Trust, Endowments, IRAs, and other Brokerage Accounts that come into existence as a result of , or without, Financial Planning.

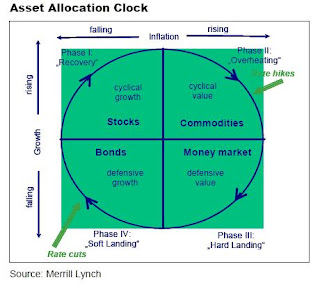

2. Asset Allocation is a planning tool that enables the Investment Manager (you, if you have not hired one) to structure the investment portfolio in the most likely to achieve the objectives of each specific investment portfolio and overall investment program. Asset allocation is the process of planning how an investment portfolio that will be divided between the two basic classes (and only two classes) of investment securities: Equities and Fixed Income. Security sub-classes have little relevance.

3. Equities are the riskier of the two types of effects, but not because of fluctuations in the price of their basic character traits. They are risky because they represent ownership in a business enterprise that could fail. The risk of capital loss can be moderated or minimized in the selection process of security and management control activity called diversification. The main purpose for buying equity is to sell them for capital gains, not to save them as trophies to brag about in chat rooms. They are less risky than others, the efforts of non-fixed income. fixed income securities is less risky because they represent debt of the issuing entity, and the owner has a claim on the assets of the publishers who excel with the holders of Equity and lawyers salivating class actions. With proper selection criteria and diversification, the risk of capital loss is negligible and price fluctuations can be ignored except that they provide trading opportunities. The main purpose of the income effect, both for current consumption or for use in the future.

4. An Asset Allocation Formula is a long-distance, semi-permanent, planning decision that had nothing to do with the market or any hedging. It is designed to produce a combination of Capital Growth and Income that will achieve long-range personal (pay the bills) goals of the individual. Thus, should not play with because of expectations about anything, or rebalanced arbitrarily because of natural changes in the market value of one asset class or another.

5. Asset allocation is the only drug that has been proven to inflation. If properly managed using the 'Working Capital Model', it will almost certainly increase the level of portfolio income by more than the inflation rate, which is a measure of purchasing power of your dollars, not the dollar value of securities purchased.

6. In addition to the potential of failing to keep up with inflation using Equity Only asset allocation, regardless of your age, greed management becomes more of a problem. In a rising market, evidenced by more profit taking opportunities than bargain a lower price, investors tend to take positions in lower quality issues, current story stocks, new issues, etc. 'just be there. A% 30 or so Fixed Income allocation can be a major focus factor. How did that to throw cold water on an old Wall Street adage.

No comments:

Post a Comment